Why Risk Management?

Risk Management is a term most frequently associated with large businesses due to its crucial importance for corporations. However, risk management activities are just as vital when it comes to personal finances. By definition, risk management is the process of understanding, analyzing and addressing potential risks to ensure objectives are achieved. Sounds simple enough, but why is it so important and what steps can you take in both business and personal finance to mitigate risk? Let’s first take a more in-depth look at what constitutes risk management.

What is Considered Risk Management?

What is Considered Risk Management?

We know based on the definition of risk management that it is the methodology used to mitigate adverse consequences that result from threats and uncertainties. Put simply, this means developing a strategy to avoid losing money when unexpected events occur. In corporate finance, this could be a succession plan that would be put into effect when a key stakeholder of the company is no longer able to perform their duties. In personal finance, however, there are many different situations which could result in financial hardships that you will want to plan for. This planning process is risk management. The primary goal of personal risk management is to protect one’s goals, dreams, treasure and personal well-being from the “what ifs” in life.

Types of Risks

Types of Risks

Generally speaking, there are four types of risk, but they are not all mutually exclusive. The first distinction is pure versus speculative risk, and a single event can be one or the other when it comes to these labels, not both. Pure risk is a loss that is only possible if an event actually occurs. For example, your house will either flood or it won’t, there is no in between. Pure risk is often insurable. Speculative risk, on the other hand, can result in a gain, loss, or no change at all. An excellent example of this is gambling. And while you can hedge against these risks (more on that later), they are not generally insurable.

Risk can also be defined as either income risk or expense risk. Just as the name implies, income risk affects your ability to produce an income. Specific examples of income risk include death, loss of work, underemployment, becoming disabled resulting in an inability to work, and, for retirees, outliving your income producing assets.

Expense risk is slightly more complicated but is essentially the idea that you will spend more money than you currently have. This can be voluntary or involuntary. For example, voluntary expense risk would be spending more money than you earn while involuntary expense risk occurs when an emergency forces you to spend money. Often times, an income risk could lead to an expense risk. You may also not be earning enough money to meet your needs, a marker of poverty.

The Risk Management Process

The Risk Management Process

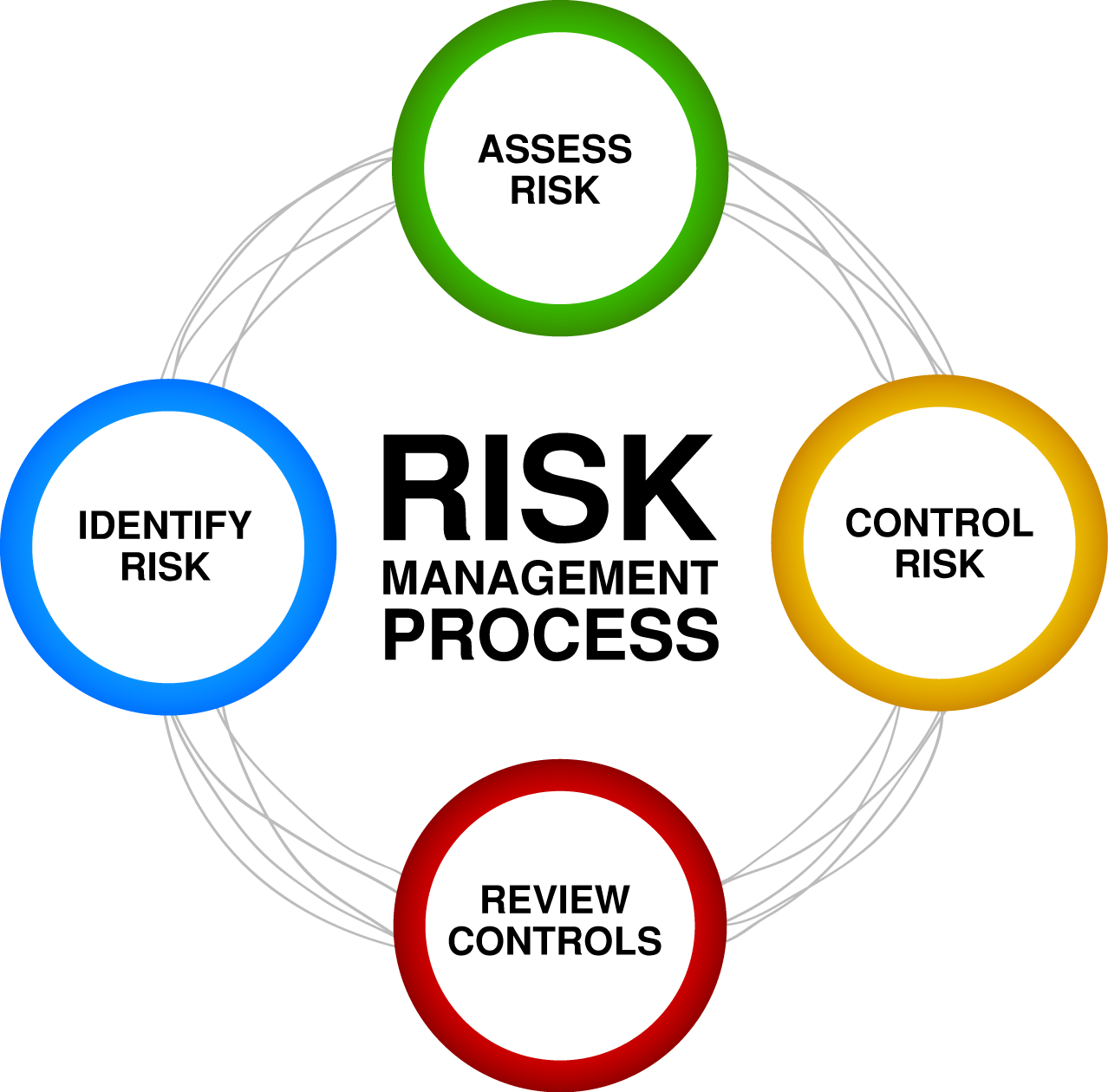

There are different methods of risk management for the various types of risk; however, the process generally has three specific steps:

1.Identify the cause and nature of the risk. To use one of our previous examples, your death would leave your family to cope with the lack of income to pay debts and living expenses.

2.Determine how much risk you are willing to retain. This could be how much deductible you are willing to assume for an insurance policy. Or it could be your choice of a living location and the associated natural disasters of the area. Generally speaking, we all assume some sort of risk every day, it is unavoidable.

3.Determine how to handle risk not retained. An important risk management factor is the balancing of insurance expenditures against the risks which present the most significant negative impact on your individual personal financial plan. In theory, we could insure ourselves against almost any risk but go broke paying the premiums.

This process should be followed for any risk you want to plan for, and the list of possibilities is nearly endless. As a result, it is important to identify your priorities alongside the risks most likely to come to fruition. This means every individual’s risk management plan will be as unique as their fingerprint. It is also crucial to know that risk management is never a stagnant process, you can’t just set it and forget. You should be reviewing your risk management strategy regularly and assessing whether or not it still satisfies your current needs and objectives.

Get in touch with us

We are just a click away to plan, to advice you, to give you the right guidance which you need to achieve your goals or complete your dream.

Book a Meeting